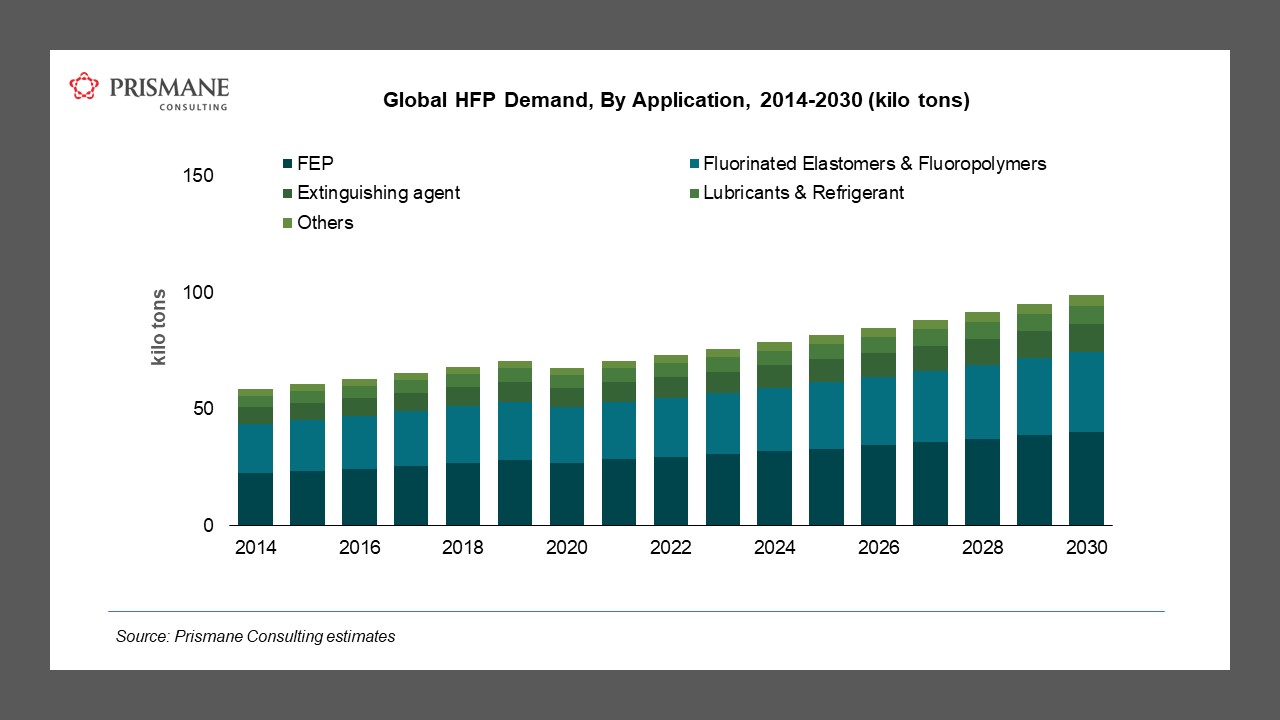

Prismane Consulting is pleased to publish its Global Hexafluoropropylene(HFP)Market Study Report. The global Hexafluoropropylene(HFP) demand is forecast to be valued at USD 1 billion by 2030, witnessing a CAGR of 4.4%.Global Hexafluoropropylene(HFP) demand is driven in large part by the development of the automotive, aerospace, and industrial uses and to a lesser degree by other applications like oil & gas, semiconductor owing to the demand of FEP, FKM and fluoropolymers in these sectors.

Fluorinated ethylene propylene (FEP) and Fluorocarbon Elastomers (FKM) to keep accounting for the lion’s share of Hexafluoropropylene (HFP) demand in the long-term forecast.

Fluorinated ethylene propylene (FEP) alone accounts for around 40% of Hexafluoropropylene (HFP) demand globally. Excellent insulating, mechanical, thermal, and chemical properties of FEP make it a material of choice in several end-use applications. Wires & Cables account for the largest share of FEP globally. Properties of Fluorinated Ethylene Propylene are similar to that of Polytetrafluoroethylene (PTFE) with the only difference being the maximum operating temperature range and colour. The global FEP demand is forecast to grow at 4% between 2021 and 2030. The global FEP production was estimated at around 40 kilo tons in 2019 and China has emerged to be the largest producer of FEP globally accounting for over 45% of the global capacity. Capacity additions are forecast in Asia with companies in China and India expected to bring online capacities in the mid-term forecast.

FKM is the second major application segment for Hexafluoropropylene (HFP). FKM is a copolymer of hexafluoropropylene and vinylidene fluoride with fluorine content around 66%. The global FKM capacity in 2019 as per Prismane Consulting’s Fluoroelastomers market model was estimated to be around 50 kilo tons with global capacity utilization rates around 80%. Asia-Pacific is expected to witness capacity additions in the mid-term forecast. The 3M company, Solvay, and Meghmani Finechem are expected to bring online FKM capacities by 2024. Prismane Consulting also speculates a few capacity additions in China, with domestic manufacturers like Juhua Group likely to expand their FKM manufacturing capacities.

Request/View TOC - Click Here

Growing Purchasing Power in Developing Economies like Asia-Pacific & Growth in Key end-user industries

Growing purchasing power in the developing economies is seen as a key driver of demand for performance elastomers like FKM, FVMQ and FFKM. The economy in Asia-Pacific has been thriving on account of the advancements witnessed in the, automotives, industrial, consumer electronics, electrical & electronics, and other end-uses. The Asia-Pacific region alone account for more than 70% of the global electrical & electronics production. Countries like China, India, Japan, South Korea, Taiwan, and Singapore have a significant manufacturing base for electronics. Electronics accounts for a decent share in their economy as well. Further with rising growth opportunities, companies from North America and Europe are investing in this region by bringing up new manufacturing facilities or through joint ventures. The manufacturing, product development and research & development activities in the automotive, industrial and electrical & electronics industry have shifted to Asian countries as this region has witnessed a growth on account of increasing disposable income and increase in standard of living. The region is also preferred for availability of skilled labor and low cost of manufacturing. The global industrial power is shifting to Asia-Pacific.

Request Sample Report- Click Here